What is a Spread Order?

A spread order is an advanced order that has multiple legs/orders within a single order. There are 2 types of spread orders

- SP order

- 2L and 3L orders

SP Orders

SP orders are used primarily for two reasons

- Trade Calendar Spreads

- Roll-over existing positions

Let’s understand them better.

Calendar Spreads

At its core, a calendar spread order performs two actions simultaneously

- Going long (buying) on one scrip/contract

- Going short (selling) on another script/contract, and vice versa

Here, the desired scrip/contract is of the same underlying.

Let us explain further...

Scrips of the same underlying with different expiry dates are available at different prices. This price difference is known as the Spread. Traders initiate a calendar spread order with the intention of profiting on the movement of this Spread.

Say Nifty Sept is trading at Rs.9800 and Nifty Oct is trading at Rs.9900, the price difference between these contracts, ie Rs.100 is known as the spread. And this is indicated as a different order called “calendar spread order of Nift Sep-Oct futures”

For example, If our trader wants to profit from the increase in spread, he/she will assume a long calendar spread position, where a sell position on Nifty Sept futures and a buy position on Nifty Oct Futures will be opened.

On the other hand, if our trader is looking to profit from the decline in the spread, he/she will assume a short calendar spread position, where a buy position on Nifty Sept Futures and a sell position on Nifty oct Futures will be opened.

Clear so far? No?… Read that again because we are just getting started.

Time for a scenario...

From the example above, our budding trader performs his analysis and concludes that the spread between these two scripts is going to increase from Rs 100 to Rs 127. If his analysis proves right, he stands to make a profit of Rs.27. So naturally, in order to execute this trade, he is looking to start a long spread position, where he will have to sell Nifty Sept Futures and buy Nifty October Futures.

Now, there are two ways our trader can do this, and the implications of these ways can vary significantly. So pay special attention, we know you got the attention span…

Method 1:

- Our budding trader first goes short on Nifty Sept Futures at Rs. 9800.

- He then proceeds to go long on Nifty October Futures, but as he is about to place a long order, he sees that the price of Nifty October futures has already moved up by Rs 20, ie to Rs. 9920.

- Our budding trader was anticipating a profit of Rs. 27, but now he only stands to make a profit of Rs. 7.

- Because of the delay in placing these orders, and the subsequent price spike in the Nifty October Futures script, he decides not to trade.

- Not only has our budding trader missed a trade opportunity, but also has to bear loss on the short position of Nifty September Futures contract.

Method 2:

- Our budding trader is well-informed and aware of calendar spread orders.

- He opens Nest trader and places a long calendar spread order on the above-mentioned scrip.

- By doing this, he/she simultaneously and automatically places a short order on Nifty Sept Futures and a long order of Nifty October Futures.

- Our budding trader can now sit back and watch the magic happen.

Important Note – When our trader initiates a long calendar spread position on Nifty Sep-Oct Futures, he/she will hold two open positions, i.e., a sell position on Nifty September futures and a buy position on Nifty October Futures. At this point, he is immune to vigorous market movements, since he’s holding two opposing positions on the same underlying. Now, when the Nifty Sept Futures contract expires on the last Thursday of September, the calendar spread order will turn into a naked buy position on Nifty October Futures, and this point our trader will now be prone to vigorous market movements.

Roll Over

A Roll Over is performed when a trader intends to carry his current month’s position to the next month. Similar to calendar spread order, rollover is performed on scrips/contracts of the same underlying.

The main difference between Calendar spread and Roll Over is that a Calendar Spread Order is a fresh order initiated by the trader to profit on the spread between two scrips/contracts. Whereas, a Roll Over is performed on an existing open position with the intention to prolong or carry the open position to the next available contracts.

So what does a Roll overdo?

A Roll Over performs two actions simultaneously,

- Close the existing position of the current month

- Open a new position in the upcoming month’s contract

For example, If our trader currently holds a long position on Nifty Sept Futures, in order to carry that position, he/she will have to close the long position on Nifty Sept Futures and initiate a long position on Nifty Oct Futures.

On the other hand, If our trader currently holds a short position on Nifty Sept Futures, in order to carry that position, he/she will have to close the short position on Nifty Sept Futures and initiate a short position on Nifty Oct Futures.

Our trader can either perform the above actions either manually or automate the process.

Pretty simple right?... No?... Alright, time for a scenario...

Our budding trader currently holds a long position on Nifty Sept Futures at Rs. 9100. Three days before expiry, he anticipates that the price can potentially move up further to Rs. 9500 in the coming month. If our trader can somehow hold this position, he could make potentially make a profit of Rs. 400. In order to execute this idea successfully, he is looking to close his existing position on Nifty Sept Futures and initiate a long position on Nifty Oct Futures.

There are two ways our budding trader can do this, and yet again, the implications of these methods can vary significantly.

Method 1:

- Our budding trader first closes his long position on Nifty Sept Futures at Rs. 9100.

- He then proceeds to go long on Nifty October Futures, but as he is about a place the long order, he sees that the price of Nifty October futures has already moved up by Rs. 150, i.e to Rs. 9250.

- Our budding trader was anticipating a profit of Rs. 400, but now he only stands to make a profit of Rs. 250 because of the sudden spike in the price of Nifty October Futures.

- And because of the delay in placing these orders, and the subsequent price increase in the Nifty October Futures script, he decides not to trade.

- Our budding trader ends up missing a trade opportunity.

Method 2:

- Our budding trader is well-informed and aware of position roll over.

- He opens Nest trader and initiates a buy spread order on Nifty Sept-Oct Futures.

- On doing this, the system automatically squares off the current Nifty Sept Futures position and places a long order on Nifty Oct Futures.

- Our budding trader can now sit back and watch the magic happen.

The above two methods clearly show you how efficient it would be to use a spread order to perform a positioning roll over. It cuts out the risk of change in prices of the contract and allows for a Roll Over at a fixed price.

2L and 3L Orders

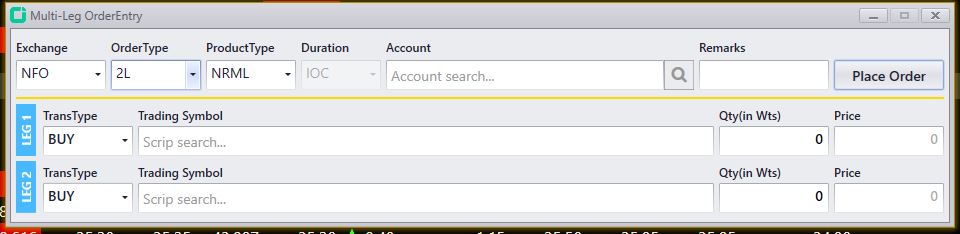

2L and 3L orders are multiple leg orders that comprise of two or three legs respectively, within the same order. These orders are mostly used for options trading, where traders can build strategies using multiple legs/ orders.

Note – Calendar spread and Roll over perform two actions simultaneously and are also considered as 2L orders. The main difference between SP type orders and 2L orders is that SP type orders must be based on the same underlying, whereas 2L orders need not be based on the same underlying.

In essence, 2L and 3L orders are IOC (Immediate or cancel) orders. This means that all the legs must execute for the order to be successfully executed. If anyone of the legs in the order fails to execute, then all the remaining orders automatically get canceled.

Let’s look at some examples. We shall choose Bank Nifty to illustrate this example.

2L Order – A Long straddle is an option strategy that involves two legs and is displayed in the screenshot below. Here,

- 1st leg – Long Call

- 2nd leg – Long Put

- 1st leg -Short Call

- 2nd leg – Short Put

- 3rd leg – Long position on Bank Nifty Futures

- 1st leg – Short Put

- 2nd leg – Short Call

- 3rd leg – Long Put

- 4th leg – Long Call

The above examples include only a few multiple-leg orders, among the thousands of strategies used in trading options. Additionally, orders placed on the same contract with the same buy/sell position on are not eligible in multiple-leg orders.

How to place a Spread Order

To place a Spread Order we must first add a spread scrip. We shall first learn how to add an SP type scrip and then how to place the order.

Adding SP type Scrips

Open Nest Trader, Right Click on market watch window → Select “Start” and Click on “Add Scrips” tab OR press “Ctrl+S” → On the Scrip Bar, Under segments, Choose “NFO” → Under Order type select “SPREAD” → Select desired month’s script to add → “Enter”

Placing a Calendar Spread Order

Open Nest Trader, On the Menu Bar, → Click on “Orders and Trades” tab → Select “Spread Order” → Under order type, select “SP” for a calendar spread and position roll over OR select “2L or 3L” for multiple leg orders → Enter details → Click “Submit”

Open Nest Trader → Select the desired spread “Script” from market watch → Press the shortcut key “CTRL + Shift + F1” to open Spread Order Entry window → Under order type, select “SP” for calendar spread and position roll over OR select “2L or 3L” for multiple leg orders → Enter details → Click “Submit”.

Modifying and Exiting a Spread Order

All pending spread orders can be modified or exited via Order Book. To Modify or Exit a spread order, open Order book either by using the shortcut key (F3) or click on “View Orders and Trades” button on the menu bar → Select “Order Book”.

Since multiple leg orders (2L or 3L) are IOC orders, they cannot remain pending. So consequently, these orders cannot be modified once they are executed. To exit a multiple leg order, open Order book either by using the shortcut key (F3) or click on “View Orders and Trades” button on the menu bar → Select “Order Book”.

Noteworthy points about Spread Orders

- Under Spread Orders the SP order type is a 2L order used to trade calendar spreads or roll over existing positions. Whereas, Multiple leg orders such as 2L and 3L are used for options trading.

- Calendar spread orders initiate new positions, whereas rollover is performed on existing positions.

- Multiple leg orders are IOC (Immediate or cancel) orders, even if a single leg of the order does not execute or remains pending, the entire order will get canceled.