If you already had all the money you ever needed, then you could safely avoid investing (or even saving). After all, the real purpose of investing in the stock market is to provide the required amount of money, when needed.

Isn’t it?

But most people are not born millionaires. So they need to save and invest in the stock market. Now people tend to use both these terms (save/invest) interchangeably. But there is a big difference between these two terms and it is important to understand it.

Saving is the process of putting aside money for short-term goals. Generally, saving doesn’t give inflation-beating returns. Inflation in India has averaged around 7% in the last decade.

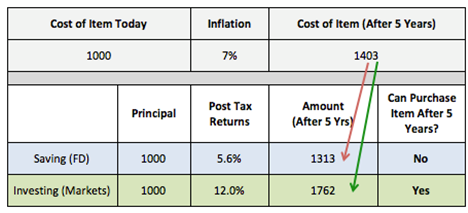

Most savings products give after-tax returns that are lower than inflation figures. So a bank FD giving 8% before-taxes, might only give 5.6% after-taxes (assuming 30% tax bracket).

This means that your savings are not beating inflation.

What exactly does this mean?

Suppose an item costs Rs 1000 in the year 2014. Since inflation is 7%, the same product will cost 1070 next year, i.e. in 2015.

Now had you invested Rs 1000 in a bank FD @ 8% in 2014, you would have received ‘post-tax’ amount of Rs 1056 in 2015 (i.e. @5.6% after-tax returns)

This amount would not be enough to buy the item that cost Rs 1000 in 2014 but due to inflation, will cost Rs 1070 in 2015.

Here is another example of how not beating inflation, reduces your purchasing power:

Now the whole idea of saving/investing for future is to beat the inflation rate with whatever investment in stock market we can make. So if we don’t beat inflation, then we are actually losing money. Hence in order to protect our future purchasing power, we need to look for better ways to grow our money.

This is where investing in the stock market comes into the picture.

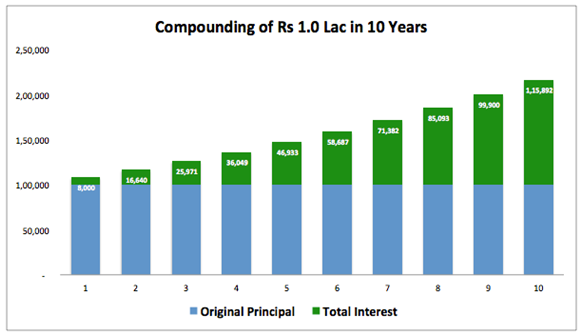

Investing is the process of putting money in assets with potential for higher and more importantly, inflation-beating returns. For example – equities (stocks).

Indian stock markets have given more than 12% average returns for last many years. But that does not mean that it has been giving 12% each and every year. Markets are volatile and might give +30% return in one year and -20% in another year. But on an average, annual returns have been around 12%. Also, stocks of growing and financially-sound businesses tend to give higher returns than these average returns. One can quote many examples of individual stocks giving returns exceeding 1000% in just a couple of years.

The idea is to understand that beating inflation is necessary to preserve the current lifestyle of an individual. The objective is to allow your money to earn more money so that it can help you buy products worth more than what you can buy today.

That is the whole point of investing.

Of course, when you invest in stocks (directly or indirectly through mutual funds), you should be ready to accept temporary volatilities.

Another point to note is that if your financial goal is years away (like retirement), then you are better off investing in assets that give higher returns– like stocks and mutual funds. Of course, the volatility in short-term will be there. But that fact is adequately compensated for by higher returns.

Some people give more weight to safety and if you are one among them, then you can still choose to invest only in low return debt instruments.

But that will mean that your investments might not grow enough, to take care of your fund needs at the time of goal realization. It means that inflation (which is higher than post-tax fixed income returns) will outpace and erode returns and reduce your accumulated corpuses’ purchasing power. And you definitely don’t want that. Isn’t it?

So even though investing seems to be risky, the fact is that not investing means taking risks too – the risk of not meeting your financial goals due to inflation.

Think about it.