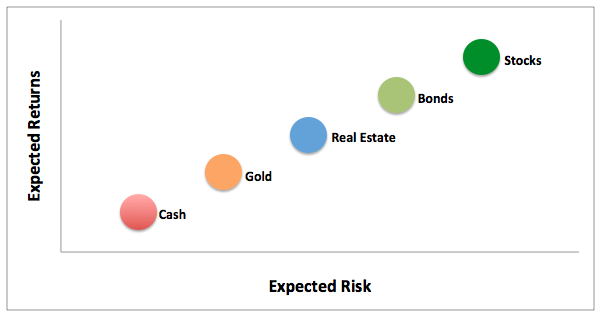

An asset can either be physical (can be touched and used like gold, real estate), or it can be financial (can be bought in form of contractual certificates like stocks, deposits, bonds etc.)Within this categorization of physical and financial assets, there are few major types of assets:

- Stocks: Stocks are representative of part-ownership in the company whose stock is being bought. Out of the profit that the company makes, a part is paid out to shareholders (stock owner) as dividends. Rest of the money is invested back in the business. In general, company’s growth potential decides how the markets value the stock. So if the markets think that company will do well in future, its share prices might go up. So in addition to dividends, shareholders also earn money by means of capital appreciation when they sell shares held by them at higher prices. Unfortunately, stock prices don’t always move up in straight line, i.e. returns are not guaranteed. But on an average, stocks are known to provide the best long-term returns among all asset classes.

- Bonds: Bonds belong to the fixed-asset class and are actually loans, which bondholders give to companies (bond-issuers). In return, the issuer promises to repay the principal along with interest to the bondholders. But a mere promise by the issuer does not suffice. So even after being called as fixed-income products, there is no guarantee that bond-issuer will be able to pay interest regularly and also repay the principal at the time of maturity. But such defaults are rare. Infact, bonds issued by the government are considered to be the epitome of safety. Having said that, ability of the issuer to repay the bond has a big influence on the bond’s rate. So higher the risk, higher will be the rates offered.

- Gold: Gold is one of the oldest asset classes and traditionally, has been held as jewelry, coins etc. Gold in itself doesn’t generate any dividend or interest income. Only means of making money from gold is to sell when prices rise above the purchase price. Interestingly, gold is known to be a good hedge against inflation and experts recommend keeping some part of one’s portfolio in gold. These days, it’s possible to invest in gold through gold ETF (exchange traded funds) and bonds.

- Real Estate: Real estate is the most illiquid of all assets. Many people consider their houses (in which they stay) as assets too. But that categorization is questionable as in case of need, one just cannot go out and sell the house to quickly arrange funds. For last many years, real estate has given great returns to many people. But there is no guarantee as making money through real-estate is not easy. And once we consider hidden costs of holding real estate like maintenance, repair, taxes, interest payments (in case bought through loan), the return figures don’t look that great. But still, real estate has been and will remain one of important asset categories in most people’s portfolio.

- Cash: Cash is the most liquid of all asset classes. Apart from the money you have at hand, it also includes money kept in savings and current accounts, i.e. it should be rightly called as cash and cash equivalents. Though cash gives the advantage of allowing investors to invest quickly in other assets, cash in itself loses value over time due to inflation (insert link to Time Value of Money article). Hence, rather than being a store of value, cash is more about parking money temporarily and using it to fund purchase of other assets.

It must be clear from above that not all assets are similar. Each has its own specific characteristic, purpose and associated risks. For example – having real estate at a time when you need cash urgently might not work. On the other hand, when you are looking to create long-term wealth, holding cash is wrong.

This is the reason that people regularly toss around the famous saying: “Don’t put all your eggs in one basket!”

Historically, the returns of various assets like stocks, bonds, gold, etc. have not moved up or down at the same time. Generally, the economic conditions that cause one asset to do well often cause others to do poorly.

Also, if one already knew which asset class was to perform best in future, the person would obviously put all his money in that asset class. But does it happen?

No. It doesn’t.

We don’t know whether stock markets will be up or down the next year. We don’t know whether gold prices will be up or down next year.

Once the concept of assets and their individual characteristics is clear, one needs to understand asset allocation – the practice of dividing your money among different asset categories. We will take this up in the next article.