Do you remember how much a week’s worth of grocery cost you 2 or 3 years back?

Does the same amount of grocery still cost you the same?

We are sure that the answer is a big and an emphatic NO!

This is the impact of inflation.

To put it simply, inflation is a general rise in prices of various goods and services year after year. With each passing year, inflation reduces the number of things you can buy with a fixed sum of money. So if you were able to purchase 5 kgs of an item for Rs 200 in the year 2011, chances are that you would get lesser amount (maybe just 3 kgs) of the same item for Rs 200 in 2016.

Causes of Inflation

Sometimes, people have sufficient money and continue to buy goods and services, thereby increasing their demand. This increase in demand leads to an increase in prices, and hence – inflation. At times, the prices of raw materials used in production can increase. The final product then becomes more expensive as producers pass on the increased cost of raw materials to customers. It is also common for a country like India to be unable to control the prices of key goods / raw materials that are not abundant.

For example – crude oil. India does not have adequate sources of crude oil to satisfy the energy demands of 1.3 billion people. Hence, it imports crude oil that is then processed to produce retail fuels like petrol, diesel, kerosene, etc. A spike in crude oil prices results in rising in fuel prices. This, in turn, increases costs of almost all goods as transportation costs increase across the country.

Impact of Inflation on Money

The biggest problem with inflation is that it reduces your buying power. Rising prices mean that you have to pay more for the same goods and services. This is a real problem. So when you are earning, you need to ensure that your income rises at least in line with inflation.

But what about your investments? Will Rs 1000 kept in savings account earning 4% be able to protect your buying power next year?

Let’s evaluate this question mathematically.

As of today, the price of petrol is about Rs 65 per liter. So in Rs 1000, you can buy 15.4 liters of petrol. If next year, the petrol prices rise to Rs 75 (which is a possibility), then how much petrol can you buy with the amount in a savings account?

Your Rs 1000 in the account would have earned Rs 40 as interest in one year. So you have Rs 1040 to purchase petrol (@ Rs75 per liter). Calculations show that you can now purchase only 13.9 liters of petrol. So from 15.4 liters, you are down to 13.9 liters. This is an example of real-life inflation.

How to Fight Back Inflation & Protect your Purchasing Power?

Now that it is clear that you need to protect your money from inflation, what is the solution?

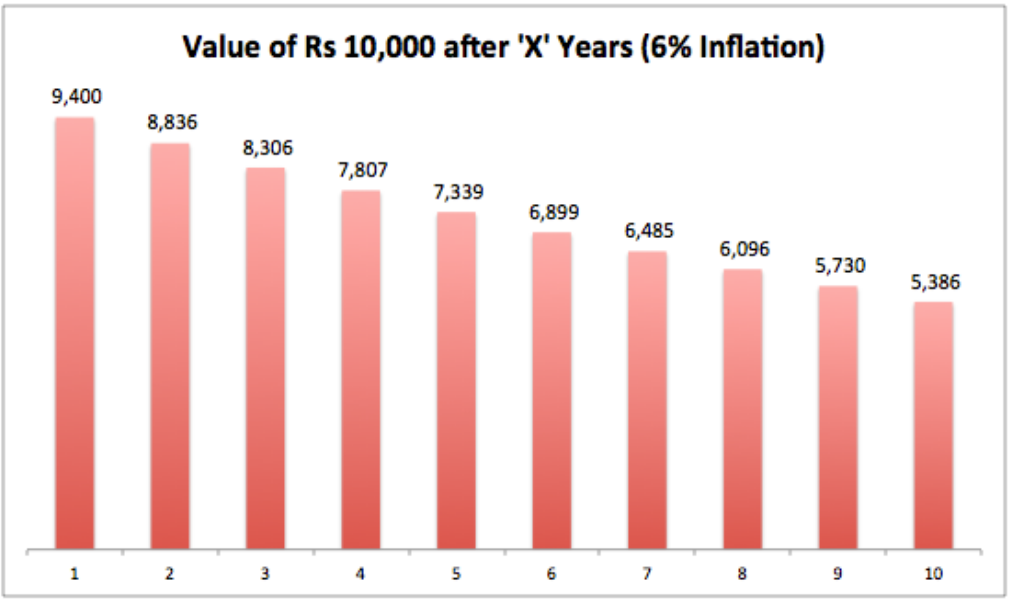

In order to ensure that your investments/savings grow by at least the rate of inflation, you need to find assets where the historical returns are comparable or better than average inflation rates. If that doesn’t happen, your money will be losing value in real terms. India has seen inflation ranging from 12% to 4% in the last few years. But on an average, inflation can be taken to be about 7%. Now think about it – savings account give 4% returns, bank deposits give 7%-8% (before taxes), bonds to give around 8%. Will these be good enough to beat inflation at 7%?

The answer is No. They still might when interest rates are high. But generally speaking, it won’t work.

So think about it. You cannot ignore inflation when taking your money decisions. You need to ensure that your money’s purchasing power is protected against inflation. And for this, you need to know what kind of returns you need to earn and more importantly, which assets can give you that kind of return.