Remember the old saying – “Don’t put all your eggs in one basket”?

We bet you do.

So what would happen if you put all your eggs in one basket? You risk losing all the eggs if that ‘one’ basket fell or is lost during transportation. Isn’t it?. Had you distributed your eggs across many baskets, you would have been reasonably sure that most of the eggs would have remained safe, even if one or two baskets were lost.

This is the basis of diversification.

It’s a strategy that requires you to spread your money across various investments. This is to ensure that in case one of those investment loses money, the other ones will compensate for the losses of first one. It’s very important to understand that the real goal of diversification is not to increase your portfolio’s performance (though it actually can). It’s more about protecting your money against large losses due fall in prices of an asset, where your money was over-concentrated.

Lets take an example to better understand this concept.

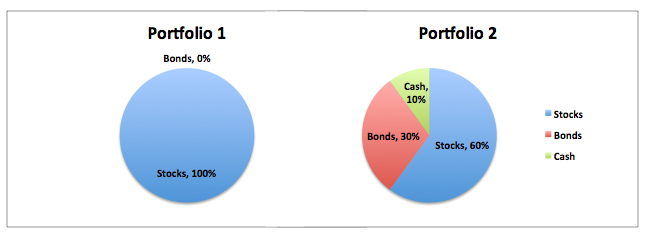

Suppose you had Rs 10 lac at the start of year 2008. You had 2 options to invest that money:

Lets see how these 2 choices would have fared by the next year. We all know that by early 2009, Indian markets fell by 50% from highs made in early 2008.

- So a portfolio with 100% stocks at original investment of Rs 10 lac would have become Rs 5 lac after 50% fall in share prices.

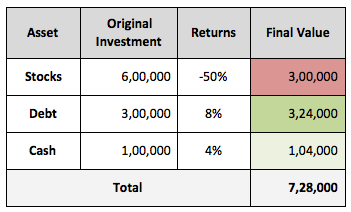

- On the other hand, the other ‘diversified’ portfolio would have given following returns:

This is what diversification does. It protects the portfolio from large drops.

Also, assets like stocks, debt, gold and cash do not move up or down at the same time. Economic factors can cause one to do well whereas cause others to do badly. So when you invest across various assets, you reduce the risk that you will loose a lot of money. If one asset’s return falls, the higher returns given by other assets will counter-balance the losses.That was above diversification across asset classes.

Now diversification actually happens at two levels:

- Across asset classes and

- Within asset classes.

So in addition to distributing your investments among stocks, bonds and cash, you also need to spread your investments within each of these assets.

The stock part of your portfolio will not be diversified if you only invest in 2-3 companies. To truly diversify your stock portfolio, you need to have a portfolio of stocks from different sector and industries. Many investors prefer to take the route of diversified equity mutual funds instead of creating their own portfolio. Mutual fund schemes invest in 30 to 50 stocks and hence, provide adequate diversification within stocks as an asset class.

Similar is the approach that needs to be taken if you want to diversify you debt portfolio. You can buy debts offering different rates of returns, with varying tenure and risk ratings. Or you can put money in debt funds that invest in various debt schemes of the government and private sector.

So make sure to spend some time thinking through – what level of diversification is best suited for your return requirements and risk appetite.