importance of choosing asset classes to invest in asset allocation

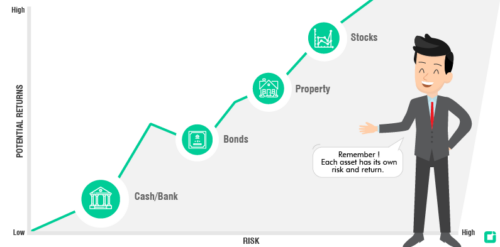

Stocks, bonds, real estate, gold and cash - there are the many asset classes that fight for a place in investors’ portfolio. Within this categorization of physical and financial assets, there are few major types of assets: But with so many available options, how should an investor decide which ones to choose and which ones to ignore? Or what percentage of the total portfolio should be parked in each of these assets? For an investor, this is one of the most important money-related decisions, which he/she needs to take. And this is what is popularly referred to as deciding the asset allocation. Having the right asset allocation helps earn better risk-adjusted returns at the overall portfolio level and also, reduce the overall risk and volatility. So what exactly is asset allocation? Asset allocation is the process of allocating your money into various asset classes. The primary goal is to have a well balanced portfolio, where fall in value of one asset is adequately compensated for by rise in another....