why is there a need to invest in stock market why should you invest in stock market

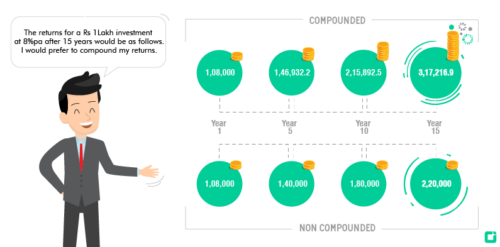

If you already had all the money you ever needed, then you could safely avoid investing (or even saving). After all, the real purpose of investing in the stock market is to provide the required amount of money, when needed. Isn't it? But most people are not born millionaires. So they need to save and invest in the stock market. Now people tend to use both these terms (save/invest) interchangeably. But there is a big difference between these two terms and it is important to understand it. Saving is the process of putting aside money for short-term goals. Generally, saving doesn’t give inflation-beating returns. Inflation in India has averaged around 7% in the last decade. Most savings products give after-tax returns that are lower than inflation figures. So a bank FD giving 8% before-taxes, might only give 5.6% after-taxes (assuming 30% tax bracket). This means that your savings are not beating inflation. What exactly does this mean? Suppose an item costs Rs 1000 in the year 2014. Since inflation...