Can you buy the same amount (value) of things for Rs 1000, that you were able to buy 5 years back?The answer is surely going to be a big ‘No’. After all, prices of almost everything are rising every year. This is what is generally referred to as the effect of inflation.On a similar note, a Rupee today is worth more than a rupee in future. Isn’t it?

On a similar note, a Rupee today is worth more than a rupee in future. Isn’t it?

It is because you can take a rupee today and earn interest/dividends/etc. on it. So it takes more than a rupee in the future, to equal a rupee today.

This is what is broadly, the concept of time value of money.

The money available today is worth more than the same amount in future, due to its potential earning capacity.

Now within this idea of Time Value of Money, there are 2 important terms that everyone must be familiar with:

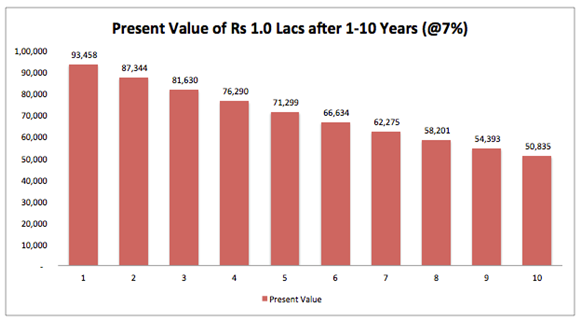

Present Value (PV)

To explain this concept with real life example, let’s take an example. Suppose you have two very simple options in front of you:

Option 1: Get Rs 1000 today

Option 2: Get Rs 1000 after 1 year

Now think about it. Why exactly is the 1st option better?

Of course waiting for an year to get the same amount doesn’t make sense. But the real point is that you can take Rs 1000 today and generate income from it.

So had you been compensated (monetarily) for waiting a year, say by giving you Rs 1100 after one year, going for 2nd option would have made sense.

This is the concept of Present Value.

Mathematically speaking, the formula for Present Value is:

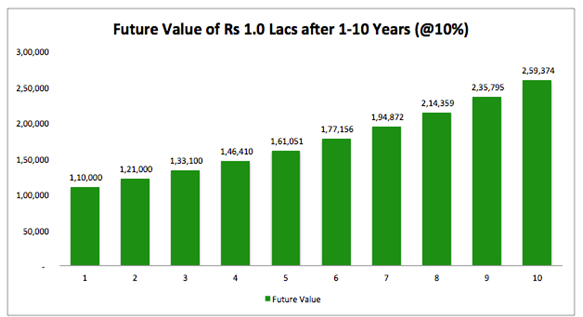

Future Value (FV)

This is easier to understand. It is the future worth of an amount that is invested today.

So if you invest Rs 1000 for one year at 8%, then the future value of the investment is Rs 1080. The mathematical formula is as follows:

Future Value = Present Amount x (1 + Annual Interest Rate)^(No. of Years)

The concept of future value is used a lot when you invest some money for the future and ask about how much you will be getting after a given period. At that point, you are actually referring to the Future value of your investment.

Like compounding, most people do not give importance to understanding the concept of time value of money. But that’s a mistake. If you don’t understand this concept, you end up making wrong financial decisions about your money and investments.

A simple thumb rule to help you remember the concept of time value of money is: