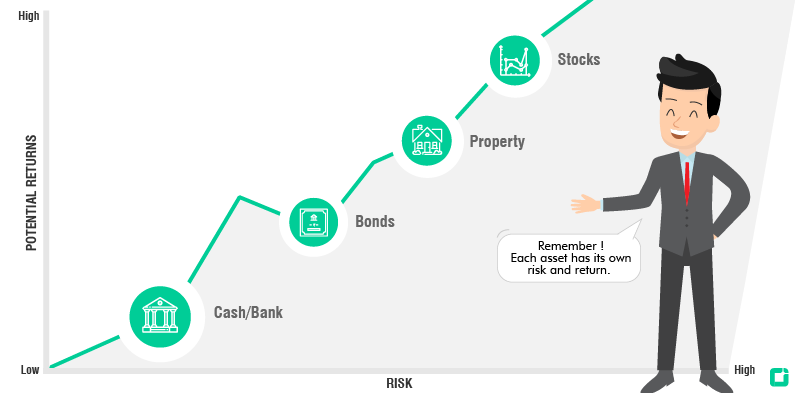

Stocks, bonds, real estate, gold and cash – there are the many asset classes that fight for a place in investors’ portfolio.

Within this categorization of physical and financial assets, there are few major types of assets:

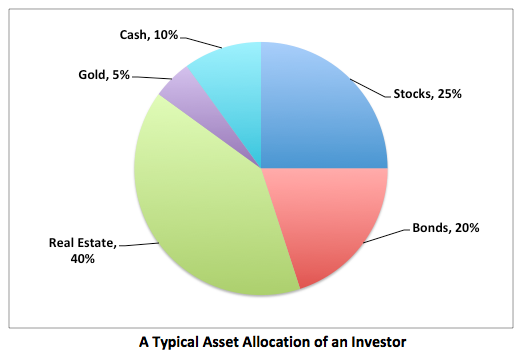

But with so many available options, how should an investor decide which ones to choose and which ones to ignore? Or what percentage of the total portfolio should be parked in each of these assets?

For an investor, this is one of the most important money-related decisions, which he/she needs to take. And this is what is popularly referred to as deciding the asset allocation. Having the right asset allocation helps earn better risk-adjusted returns at the overall portfolio level and also, reduce the overall risk and volatility.

So what exactly is asset allocation?

Asset allocation is the process of allocating your money into various asset classes.

The primary goal is to have a well balanced portfolio, where fall in value of one asset is adequately compensated for by rise in another.

Lets take an example.

Suppose 30% of your Rs 1 crore portfolio is invested in stocks, i.e. Rs 30 lakhs.

Another 15% is allocated to gold and rest to real estate, cash and bonds.

Now due to some global economic crisis, the stock markets go down by 10% and so does your equity portfolio. So the value of your equity investments is down 10% to Rs 27 lakhs (Rs 30 lakhs – 10% of Rs 30 lakhs).

As already discussed in previous article (insert link here), all assets do not move in tandem. Historically, whenever there is an economic crisis, gold starts behaving as a natural hedge and its prices tend to either remain stable or start rising.

So if that was true in the current example too, then the 15% ‘gold’ in the portfolio would help compensate for the fall in equity portion of the portfolio. Isn’t it?

So if gold prices had risen by say 10% in this duration, the value of gold holdings in the portfolio would become Rs 16.5 lakhs (Rs 15 lakhs + 10% of Rs 15 lakhs).

Assuming that rest of the assets like bond, cash and real state stay stable, a fall of Rs 3 lakhs in equities is partially compensated by a rise of Rs 1.5 lakhs in gold.

This is what asset allocation tries to achieve. It allows you to protect your portfolio by selecting diverse assets classes, that will not only appreciate in value, but also protect the downside at portfolio level, even if few of the assets are not performing at their best.

That brings us to the next important question.

How to decide which assets to invest in?

Every person’s asset allocation strategy will be unique. Broadly, it depends on the person’s financial profile, age and risk tolerance. But more specifically, it depends on investor’s time horizon and risk appetite.

Historically, investing in stocks for long term has been known to generate the best inflation-beating returns for the investor. But in short term, this asset class (stocks/equities) is volatile. Hence, if your time horizon is long, preferably more than 5 years, then stocks are a good choice to allocate a major part of your portfolio.

Then again, a lot depends on your risk tolerance. As already mentioned, stocks give the best average long-term returns. But most investors don’t have the actual appetite to see their portfolios move up and down a lot. For them, it’s tough to pass through periods of under-performance, which are pretty normal in stocks.

But building a complete asset allocation strategy requires a lot more than just discussing about the above two factors.

Classifying asset classes by time horizon, we can say that:

- Stocks – Good for long-term portion of your asset allocation strategy. (Trading in stocks is a different matter altogether)

- Bonds – Are low-risk, come in many varieties and hence, can be chosen to suit short-term, medium-term or long-term needs of the strategy

- Real Estate – Best suited for long-term

- Gold – A good hedge against fall in other asset classes. Gold prices can be volatile in short term but generally are known to provide decent capital appreciation in line with prevalent inflation.

- Cash – Cash always loses real value because of inflation. But it’s good to have some part of the portfolio in cash, so that one is ready to face any unexpected expenditures or opportunities.

On a concluding note and as already mentioned, final decision about the ideal mix of assets depends on the level of risk an investor is ready to take.

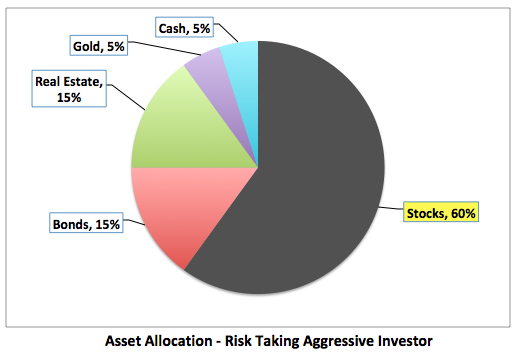

So for someone who is willing to take more risk and accept higher volatility in an attempt to generate higher returns, then his/her portfolio would probably have a larger part of equities (stocks).

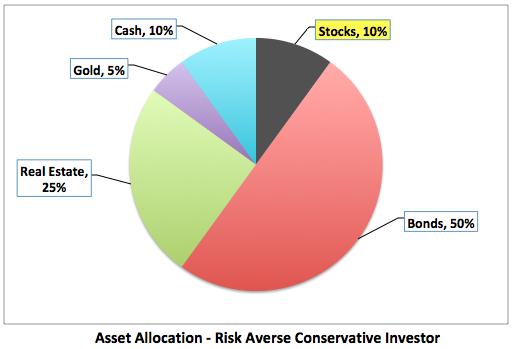

On the other hand, for a person who seeks moderate returns, relatively low risk and volatility, he/she might go in for a portfolio where bonds, cash and gold form a major chunk. As for stocks, they will form a much smaller portion of the overall portfolio.