COMMODITY DERIVATIVES

Indian markets have thrown open an avenue for retail investors and traders to participate commodity derivatives. For those who want to diversify their portfolios beyond shares, bonds and real estate then commodity trading is one of the best options.

Commodities actually offer immense potential to become a separate asset class for market-savvy investors, arbitrageurs and speculators. Retail investors, who claim to understand the equity markets, may find commodities an unfathomable market. But commodities are easy to understand as far as fundamentals of demand and supply are concerned. Retail investors should understand the risks and advantages of trading in commodities futures before taking a plunge.

Commodity market is an important constituent of the financial markets of any country. It is the market where a wide range of products, viz., precious metals, base metals, crude oil, energy and soft commodities like palm oil, coffee etc. are traded. It is important to develop a vibrant, active and liquid commodity market. This would help investors hedge their commodity risk, take speculative positions in commodities and exploit arbitrage opportunities in the market.

From food products in India to building new homes in Europe or to running cars in the US; each one of these require the necessary raw materials that are used to create products which are consumed in everyday life around the world. Such raw materials are products that can be bought, sold or traded in different kinds of markets and what we call as commodities.

Commodity markets have been in existence in India for over 120 years with its initial stages being unorganized in regional and local Mandis. With the advent of exchange based trading, it has brought about a paradigm shift with the introduction of more volume, risk mitigation etc leading to a huge appetite for speculation along with equity players expanding into commodities.

Commodities have played a major role in shaping the global political economy and have affected the lives and livelihoods of people by channelising into two types of commodity markets: spot (physical) and derivatives (such as futures, options and swaps).

In a spot market, a physical commodity is sold or bought at a price negotiated between the buyer and the seller. The spot market involves buying and selling of commodities in cash with immediate delivery. On the other hand, a commodity can be sold or bought via derivatives contract as well. A futures contract is a pre-determined and standardized contract to buy or sell commodities for a particular price and for a certain date in the future.

Empirical researches have been carried out to understand the effect of introduction of derivatives on the volatility of the spot markets and also to explore its role in stabilising or destabilising the cash markets. It is widely known that stock return volatility is highly persistent, especially in the developing markets. High levels of price volatility exhibited by the stock markets emphasizes on the need to examine the dynamics of volatility, to reduce the unpredictable outcomes. The volatility behaviour of the stock market has become further complicated with the introduction of derivatives in the equity markets in the major world markets. The derivative instruments were launched with the objectives to transfer risk and to increase liquidity, thereby ensuring better market efficiency. Along with this, derivatives open new avenues for hedging and speculation, which further complicates the volatility behaviour of the stock markets.

Throughout the past decade the commodity futures market in India and abroad has witnessed a significant growth in terms of both network and volume. In general, the commodities market survives in two distinguishable forms—the over-the-counter (OTC) market and the exchange based market. These markets influence the dynamics of production and resource allocation in the primary sector, along with pricing system of this market. The greatest achievement of this system was the establishment of the focused market. The prime impetus of this market is to provide a mechanism to determine the prospects of the future production and consumption which shall be brought to bear on the present prices. Thus, this market established a link between the present and future production and consumption cycles thereby facilitating the inter-temporal smoothing of prices.

India is one of the top producers of a large number of commodities ranging from agricultural to nonagricultural products, with a long history in its trading market. It has been progressing in terms of technology, transparency and trading activity with the removal of government protection from a number of commodities. This action of our government has thus, allowed the market forces i.e. supply and demand, to rule the commodity.

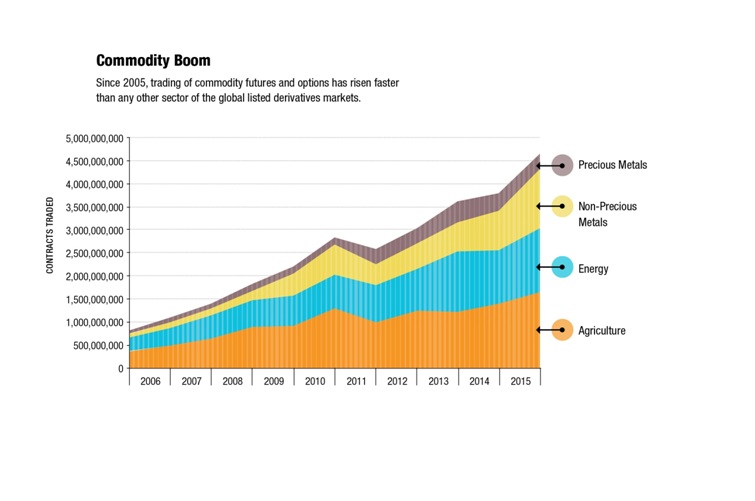

In 2015 contracts based on equity indices, currency exchange rates, and commodities were the three categories that had a prominent growth rate . The total number of equity index futures and options increased by 13.7% leading to a total of 8.34 billion contracts. Some of this growth came from markets where contract sizes are relatively small, such as the National Stock Exchange of India.

Commodity contracts, which include futures and options based on energy, agriculture, precious metals and non-precious metals, escalated by 22.6% giving rise to 4.6 billion contracts. That was a record amount of trading across these four categories, and on a combined basis commodity futures and options now account for almost 19% of global volume. The upswing in commodity trading was not limited to any one sector. Agricultural volume rose 18.1% to 1.6 billion contracts, energy volume rose 21.2% to 1.4 billion, and non-precious metals volume rose 46.8% to 1.3 billion. All three sectors had record levels of trading activity in 2015.