TECHNOLOGY

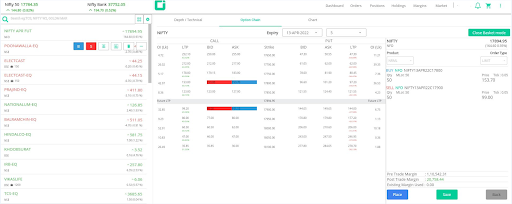

CUBE TRADER

CUBE Trading Terminal is an intuitive desktop trading platform offered by Tradejini and it is designed for active traders with faster order execution capabilities.

CUBE WEB

Tradejini provides you the convenient trading system that can be operated anywhere, anytime with a few simple clicks of the keyboard.

CUBE TRADER

CUBE Trading Terminal is an intuitive desktop trading platform offered by Tradejini and it is designed for active traders with faster order execution capabilities.

CUBE WEB

Tradejini provides you the convenient trading system that can be operated anywhere, anytime with a few simple clicks of the keyboard.

CUBE MOBILE

CUBE Mobile App provides all the features of a full-fledged online trading platform, right inside your smartphone. Just let you trade on the go. Monitor the markets and Trade from anywhere and everywhere.

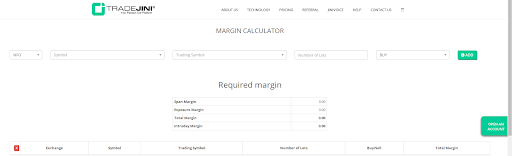

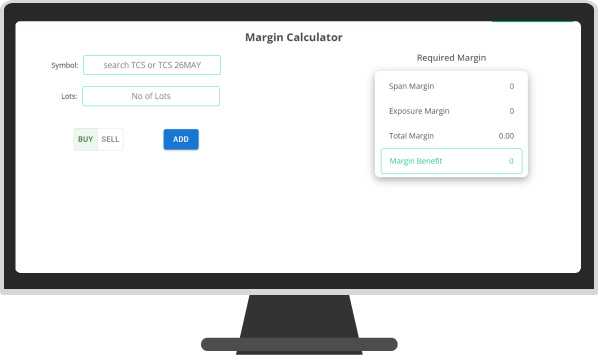

MARGIN CALCULATOR

The Tradejini F&O Margin calculator let’s you calculate comprehensive exchange margin requirements for option writing/shorting, Pair trades or for multi-leg F&O strategies while trading equity.

CUBE MOBILE

CUBE Mobile App provides all the features of a full-fledged online trading platform, right inside your smartphone. Just let you trade on the go. Monitor the markets and Trade from anywhere and everywhere.

MARGIN CALCULATOR

The Tradejini F&O Margin calculator let’s you calculate comprehensive exchange margin requirements for option writing/shorting, Pair trades or for multi-leg F&O strategies while trading equity.

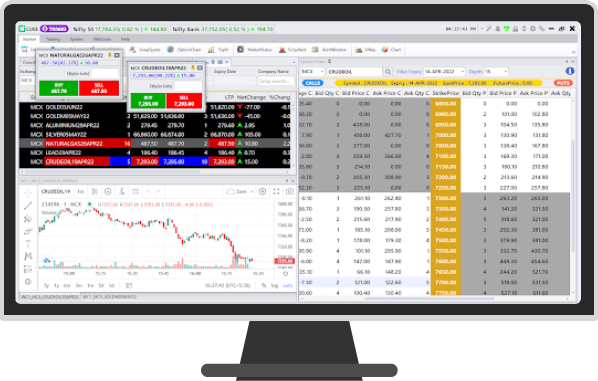

NEST TRADER

Nest Trading Terminal is an intuitive desktop trading platform offered by Tradejini and it is designed for active traders with faster order execution capabilities.

WEB BASED TRADER

NOW is the acronym for NEAT on Web ( NEAT – ‘National Exchange for Automated Trading) which is NSE’s pioneering, fully automated screen based trading system

NEST MOBILE

NEST Mobile App provides all the features of a full-fledged online trading platform, right inside your smartphone. Just trade on the go. Monitor the Markets and Trade from anywhere and everywhere.

SMART ORDER

Bracket order is an innovative feature for day traders to take advantage of high margin exposure with safe and controlled risk. Bracket order is a set of three orders placed simultaneously.

MARGIN CALCULATOR

The Tradejini F&O Margin calculator let’s you calculate comprehensive exchange margin requirements for option writing/shorting, Pair trades or for multi-leg F&O strategies while trading equity.

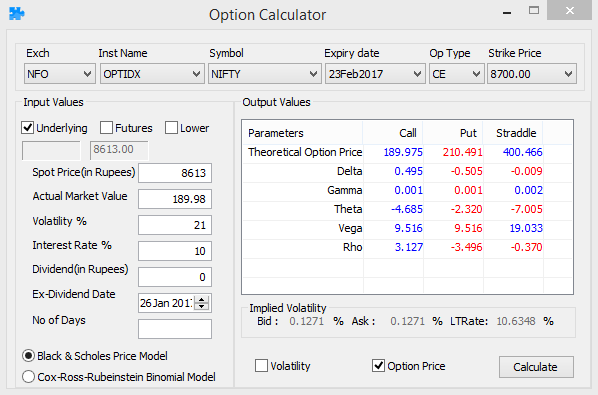

OPTION CALCULATOR

Our Black-Scholes Options calculator helps you to calculate the Option Greeks (Delta, Gamma, Theta, Vega, and Rho). It also calculates the theoretical value of an option’s premium.

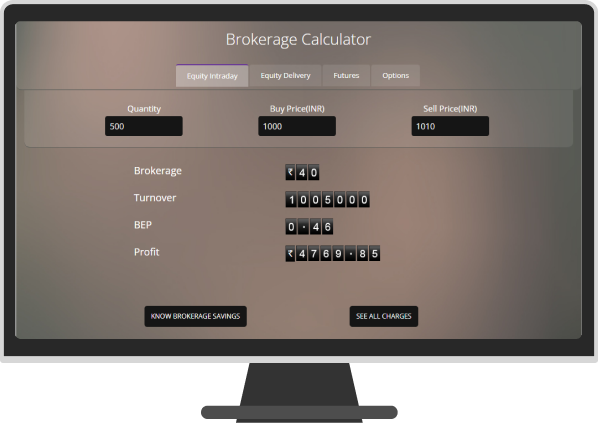

BROKERAGE CALCULATOR

Our Brokerage structure and Brokerage Calculators are extremely transparent and detailed. Use the online brokerage calculator to get a segregated view on Brokerage.

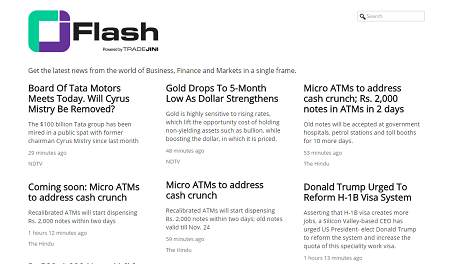

FLASH

Flash by Tradejini brings you the curated latest financial and market related news from various news sources in a single frame

BROKERAGE CALCULATOR

Our Brokerage structure and Brokerage Calculators are extremely transparent and detailed. Use the online brokerage calculator to get a segregated view on Brokerage.

CUBE Trader

CUBE Web

CUBE Mobile

Margin Calculator

Brokerage Calculator

Our Brokerage structure and Brokerage Calculators are extremely transparent and detailed. Use the online brokerage calculator to get a segregated view on Brokerage, STT, Transaction Charges, Government Charges & SEBI Charges.It gets you break-even points before planning your trades. Trading with Tradejini will help you to reduce your break-even points compared with any other traditional broker which you can literally visualize from our trading calculators.

NEST TRADER

Nest Trading Terminal is an intuitive desktop trading platform offered by Tradejini and it is designed for active traders with faster order execution capabilities. NEST supports Multi Exchange and Multiple Segment Trading. Nest Trader gives the customers real time access to scrip quotes which is blazingly fast. It supports advance order types like Bracket Order and Cover Order.

WEB BASED

NOW is the acronym for NEAT on Web ( NEAT – ‘National Exchange for Automated Trading) which is NSE’s pioneering, fully automated screen based trading system. Tradejini provides you the convenience of this trading system that can be operated anywhere, anytime with a few simple clicks of the keyboard. It allows for direct access to NSE servers which decreases the trade turnaround time drastically thus boosting the trade execution speed and convenience. Lightning fast streaming quotes and charts, even at slow internet speed.

NEST MOBILE

NEST Mobile App provides all the features of a full-fledged online trading platform, right inside your smartphone. Just trade on the go. Monitor the markets and Trade from anywhere and everywhere. Lightning fast streaming quotes and charts, even at slow internet speed. You can download mobile app from Google play store and Apple iOS.

Smart Order

Bracket order is an innovative feature for day traders to take advantage of high margin exposure with safe and controlled risk. Bracket order is a set of three orders placed simultaneously. Bracket orders can be used to execute trades with better risk-reward ratio, where you want to limit your potential trading losses and allow the profits to be executed with a pre-defined risk reward ratio.

Cover order is a high leverage feature for intra-day traders to take advantage of high margin trading exposure with safe and controlled risk. Cover order is a set of two orders placed simultaneously. Cover orders can be used to execute trades with better risk-reward ratio, where you want to limit your potential trading losses and allow the profits to run. Cover Orders enable traders to maintain their trading discipline.

Margin Calculator

The Tradejini F&O Margin Calculator let’s you calculate comprehensive exchange margin requirements for option writing/shorting, Pair trades or for multi-leg F&O strategies while trading equity, F&O, commodity and currency before taking a trade. It helps the trader in visualizing the margins required and benefits of entering the strategy.

Option Calculator

Our Black-Scholes Options calculator helps you to calculate the Option Greeks (Delta, Gamma, Theta, Vega, and Rho). It also calculates the theoretical value of an option’s premium. Option Calculator lets you to incorporate greeks into your strategy / design and helps you to determine the risk and reward potential.

Brokerage Calculator

Our Brokerage structure and Brokerage Calculators are extremely transparent and detailed. Use the online brokerage calculator to get a segregated view on Brokerage, STT, Transaction Charges, Government Charges & SEBI Charges.It gets you break-even points before planning your trades. Trading with Tradejini will help you to reduce your break-even points compared with any other traditional broker which you can literally visualize from our trading calculators.

Flash

Flash by Tradejini brings you the curated latest financial and market related news from various news sources in a single frame. It is fast, intuitive and responsive and requires low internet bandwidth to access our flash news application. It provides a snapshot overview about the markets and helps in keep you with upto date information about markets.

CUBE TRADER

CUBE Trading Terminal is an intuitive desktop trading platform offered by Tradejini and it is designed for active traders with faster order execution capabilities. It has Key features like GTT Orders [Good Till Trigger], OCO orders [One Cancels the Other], Trading Widgets [Quick Order], Order Slicing, Option Greeks, Payoff Graphs, SIPs Etc.,

key features

The quick trade widget facilitates order placement in just one click. This is an on-screen floating window that can be placed anywhere in and outside the application window. This tool is mainly used for scalping.

Smart orders include Bracket Order, Cover Order, Multi-leg order, Spread Order, Basket order, SOR [Smart Order Routing] Order and Trigger order.

Option greeks is a vital tool representing the sensitivity of the value of a portfolio to a small change in the parameters such as price, time, volatility, interest rate of the underlying asset.

The graphical representation of an options payoff showing the risk/reward of an option or combination of options for an existing portfolio.

CUBE WEB

Tradejini provides you the convenient trading system that can be operated anywhere, anytime with a few simple clicks of the keyboard. CUBE Web delivers lightning fast streaming quotes and charts, even at slow internet speed. It has Key features like GTT Orders [Good Till Trigger], OCO orders [One Cancels the Other], Order Slicing, Option chain with Basket mode, SIPs, Etc.,

key features

WPIN is a 4 digit Web Personal identification number which can be used for quick accessing to the web-based CUBE terminal. The user needs to login using the credentials sent to their registered email address. Post login, the user shall be provided with an option to set WPIN for quick login thereafter. WPIN can also be set by clicking on header “Security” under the User Profile [Client_Code] provided on the top-right corner of the screen.

Users now need not switch between tabs to create a basket. Tradejini provides a user-friendly tool of creating a basket directly from option chain with a very minimal clicks. This helps in quick order placing and provides the real-time margin required for various strategies.

Users can apply for IPO using Cube Web. Click on the 3 dots on the right top of the screen and follow the prompts. IPO can be applied using your UPI ID

Tradejini provides free API Key for Algo users. To generate your free API, login to Cube web and click on API Key provided on the top- right corner of the screen.

CUBE MOBILE

mCUBE Mobile App provides all the features of a full-fledged online trading platform, right inside your smartphone. Just let you trade on the go. Monitor the markets and Trade from anywhere and everywhere. It has key features like GTT Orders [Good Till Trigger], OCO orders [One Cancels the Other], Order Slicing, Option chain, SIPs, etc.,

Click here to download

key features

The user needs to login using the credentials sent to their registered email address. Post login, the user shall be provided with an option to set MPIN [4 digits Mobile Personal identification number]/Biometric for quick login thereafter. MPIN/Biometric can also be set by clicking on the User Profile [Client_Code] provided at the bottom of the screen.

Users can apply for IPO using Cube Web. Click on the 3 dots on the right top of the screen and follow the prompts. IPO can be applied using your UPI ID

e-DIS is a facility which allows you to sell your settled shares even if you have not submitted your Power of Attorney (POA). You’ll have to use the CDSL TPIN and OTP to authorise the debit of securities from your demat account against a delivery sale transaction.

Click on the option “More” available at the bottom right corner of the app to know the Market Movers such as Top gainers/losers, Active by volume and Active by value and Content & Analysis such as volume shocker, Rise & Fall, Strong & weak, Circuit breakers, OpenHigh/Low, High/Low breakers, Resistance and Support.

Additional features

GTT orders are a special feature where the orders are sent and gets placed to the exchange only when the set trigger Price condition gets hit, irrespective of the time taken to reach it. The execution of the order is dependent on the order price and the funds available in the account. Once the GTT order is Triggeried it is not carried forward irrespective of its execution. In such a case, the GTT order needs to be placed again. GTT time limit is one year from the date of order placement or GTT trigger whichever is earlier.

OCO Order is a subsidary feature of GTT. This feature can only be used on your current Equity holdings and FNO open positions. This allows you to place 2 conditional orders (Target and Stop-loss) stipulating that if one order gets executed, then the other order is automatically cancelled. The execution of the order is dependent on the order price and the funds available in the account. Once the OCO order is Triggeried it is not carried forward irrespective of its execution. In such a case, the OCO order needs to be placed again. Time limit is one year from the date of order placement or OCO trigger whichever is earlier.

An option matrix listing of all available options contracts for a given security. It shows all listed calls, puts, strike prices, volume, IV (Implied Volatility), OI (Open Interest) and pricing information for a single underlying asset within a chosen expiry with filter options on Exp Date & No of strikes

TradingView is a dominant technical analysis charting tool that has most of what you need for your day-to-day trading such as drawing tools and a set of tools for in-depth market analysis, covering the most popular trading concepts.

Order slicing divides a large order[Within/beyond the freeze limits] into a series of smaller orders automatically.

SIP [Systematic investment plan] in Equity stocks is a do it yourself tool provided for investing in your desired stocks in a regular interval of time.

Points to note:

1: The Stock SIP order execution is subject to availability of funds in your account, demand and supply of the stock on the scheduled date.

2: All the Stock SIPs are sent to exchange at 9:30AM as a market order

3: Incase the SIP scheduled date is an holiday, it will be considered for the next trading day

4: The schedules in the stock SIP feature will not be automatically modified in case of corporate actions like dividends, split, bonus etc.